Marvell’s Quest for Growth in a Shifting Tech Landscape

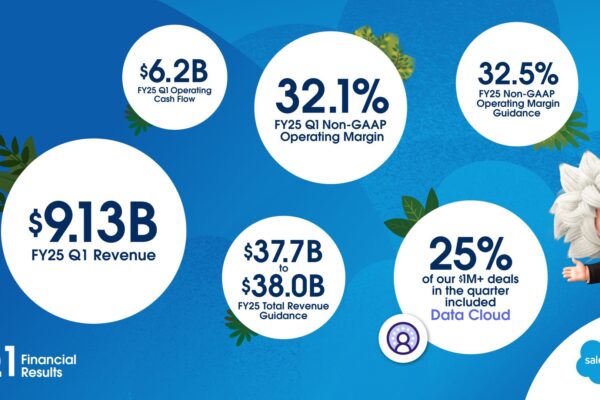

Marvell Technology provides a recent glimpse of a tech powerhouse in a tug-of-war between the massive growth potential of AI and a sobering shift in the market. Gobs of money have been pouring into AI applications. Though usually defined in terms of software, much of that funding involves hardware, and Marvell is one of the largest players. Its data center business – the hardware sold into the supercomputer facilities that AI designers use for bringing the latest AI products to market – rocketed 48 percent in its latest results for the first quarter of 2022. But other businesses were down sharply – can Marvell’s AI growth buoy the others, or will it have to chart a more complex path?

A Tale of Two Markets: AI Triumphs, Other Sectors Struggle

Star of the show was Marvell’s business making the chip platform for enormous data-center farms, whose third-quarter revenue climbed 87 percent over the same quarter last year, partly owing to the booming appetite for AI. That success reflects wider trends in the popularity of AI products.

However, what the data center part of the business was gaining, the other parts were losing: revenue breakdown across the company’s divisions revealed devastating year-over-year declines, from a worrying 13 percent drop to a sickening 75 percent. The fluctuating demand was what differentiated the frenetic nature of the semiconductor industry compared with one of Intel’s largest and, at the time, rapidly growing customers: Eastman Kodak. While demand for Kodak’s film photography products escalated, the film-related businesses of Intel’s main rival, NEC, floundered in the face of waning demand.

A Look Back: Setting the Stage for Change

To understand what’s happening to Marvell right now, it helps to zoom out first. The company gave investors fair notice in March that the quarter would be difficult. Presumably, an internal ‘pivot to AI’ is underway, all while it reallocates product portfolios in other areas.

A Glimpse into the Future: Recovery, Repositioning, and the Power of AI

Looking ahead, however, Marvell remains optimistic, eyeing a turnaround in the second half of the fiscal year, pointing to what they call ‘ramping custom AI silicon’ as a key growth driver. This is a clear commitment to the AI tech that Marvell has excelled in and suggests a doubling down.

Meanwhile, analysts are feeling this way, too. Jefferies, the financial services firm, boosted its price target on Marvell stock this month, touting the potential for AI to increase sales as well as noting the company’s other operations could gradually come back online as well – suggesting a ‘scorched earth’ approach to a fiscal climb-back.

Beyond the Numbers: The Challenges and Opportunities of AI

On the plus side for Marvell, there’s no doubt that AI represents an opportunity. Look at it this way: $10 billion was paid for an AI start-up last year[2], MindMeld. This shows that interest in AI is ramping up quickly. However, there are challenges too: the AI market is competitive and highly competitive. Google, NVIDIA, and Intel are all competing in the space. Marvell has to innovate continuously to stay ahead of the curve.

Second, ethical considerations regarding AI development and deployment are paramount. Concerns include algorithmic bias and the potential for job displacement. Marvell can lead the way in developing responsible AI solutions that contribute to the public good.

Beyond AI: Diversification and Strategic Partnerships

True as that is, AI also holds great growth potential, so Marvell needs to balance the situation. Abandoning the company’s other lines of business would be short-sighted and too risky. Even though machine learning is a fast-growing area, a company should not put all its eggs into one basket. Having a product variation strategy is important to manage the risks that come with a highly volatile market. A company might, therefore, need to pursue strategic partnerships or acquisitions that help to close product voids or cover future risks.

Besides, non-AI areas of new technologies could offer net positive results – such as the Internet of Things (IoT), for example. Focusing on these growing areas can create a more balanced and more resilient business model for Marvell.

The Road Ahead: A Balancing Act for Marvell

Marvell’s path forward depends on maintaining this see-saw. The company needs to make the most of the momentum to serve the AI market, but it also has to determine where to shore up those other houses that aren’t quite built so well. Marvell’s future success will hinge on effective diversification, the right partnerships, and a continued holistic approach to developing AI responsibly.

The quarterly numbers are not a death knell: instead, they’re a wake-up call about how to reinvent as technologies change. But as of now, Marvell could be Kodak revisited; if it figures out the maelstrom in which it currently finds itself, the firm could become a tech industry leader for the one or two decades to come.