Salesforce Rout Sparks Sell-Off After Dismal Earnings

US equities descended Thursday as major tech names faltered, led by a dreadful earnings report from Salesforce. The cloud software company’s forecast caused a rout that sent the Nasdaq down more than 1 percent.

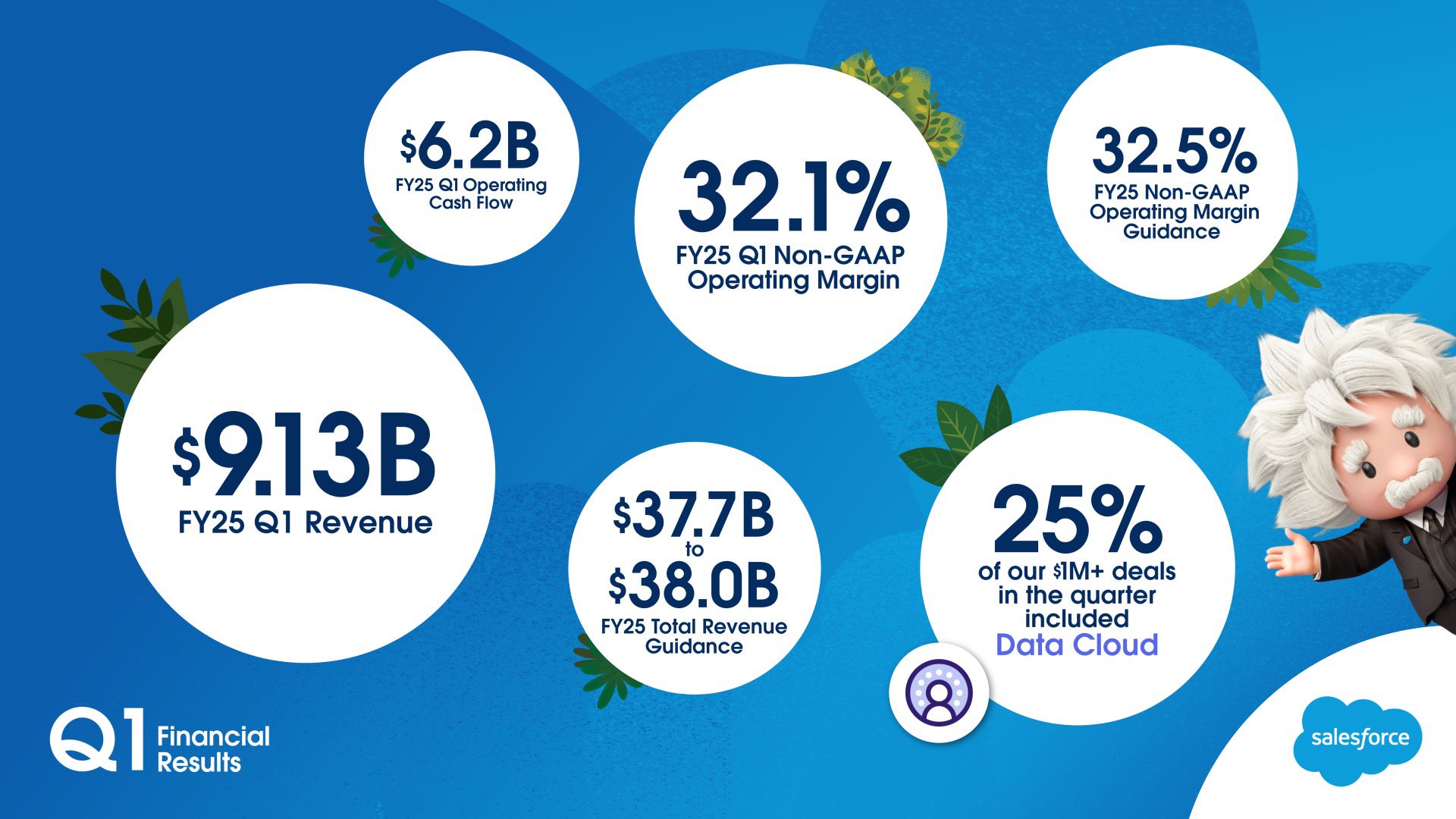

Shares in Salesforce took a nose dive – the biggest daily percentage drop in nearly 20 years – after the company missed its revenue projections and provided weak guidance for the next quarter. Seasonal factors – longer sales cycles, risk-averse customers – caused the shortfall, the company explained. Analysts’ assessments were a mixed bag: some called it a ‘total mess’, others a ‘bump in the road’.

That affected not only Salesforce, but several other software companies that similarly reported lackluster results: UiPath, an enterprise automation software provider, lost 34 percent of its value after it disclosed a fourth-quarter loss wider than expected, and said its CEO would step down; Okta’s stock fell 8 percent, even after it increased its revenue forecast.

There was an exception to the tech route. Shares in the cloud security company C3.ai closed 19.5 percent higher on news of strong earnings. Artificial intelligence was continuing to be a bright spot: shares in HP Inc. jumped 17 percent on the shift to AI-enhanced personal computers.

Outside of tech, the market was a mixed bag. Investors digested key economic data that showed slower-than-forecast growth, which sent Treasury yields slightly lower. Apparel and retail shares rose on the heels of better-than-expected earnings reports from Foot Locker, Birkenstock, and TJX Companies.

The two-day tech sell-off is a sign of investor angst over the sector’s growth prospects. Earnings season is also underway, as investors want to see how other ‘late-cycle’ stocks will fare.